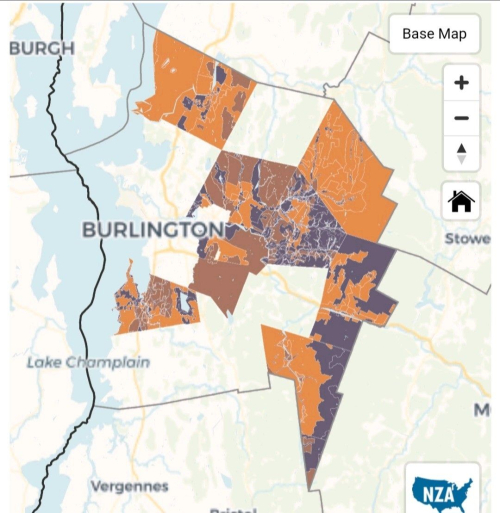

The Vermont Zoning Atlas team is seeking volunteers to help complete its build-out across the state. This is an exciting opportunity to join a national data standardization project, be part of a grassroots team and be among the first researchers to work with raw zoning data across Vermont. The project started this summer by focusing on Chittenden County towns.

Data and Statistics

Vermont Housing Data website gets comprehensive update with latest data available

The most recent data available has been added to the Vermont Housing Data website at www.housingdata.org which is managed by VHFA. The updates to the website include the most recent American Community Survey (ACS) 5-year estimates from the U.S. Census Bureau as well as new data from the Multiple Listing Service (MLS), the Vermont Department of Taxes, the National Low Income Housing Coalition’s (NLIHC) Out of Reach report, and more. The data available on HousingData.org provide a variety of visualization for housing indicators in every town and county in Vermont. This data can be used to help identify housing trends and need within the community for everyone from lawmakers to nonprofits and local governments.

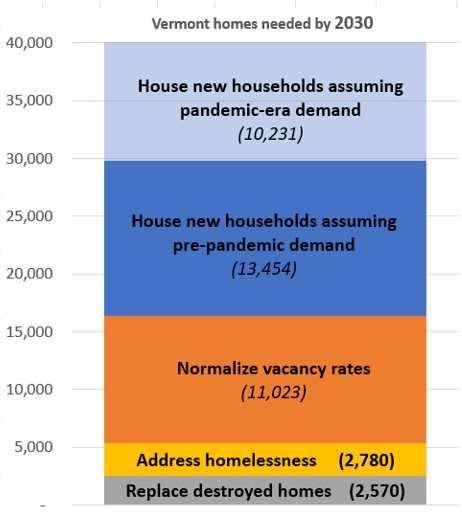

Why Vermont needs 30,000-40,000 more homes

Earlier this year VHFA projected a need for 30,000-40,000 more homes by 2030. These projections are based on data from the U.S. Census Bureau and from the Vermont Point-In-Time Count of people experiencing homelessness.They are also based on common assumptions about the drivers of Vermont’s housing needs, such as the ideal vacancy rate among the state’s housing stock.

New data shows unprecedented jump in Vermont median home price

The median price of a Vermont home jumped to $310,000 in 2022, an historic 15% increase from the prior year. This is the largest annual percentage increase in the median sales price of primary homes since 1988 when the Vermont Department of Taxes began publishing home sales data. Among newly-built Vermont homes exclusively, the median price rose to $555,264 in 2022, up 21% from the prior year.

30,000 to 40,000 more Vermont homes needed by 2030

To meet expected demand and normalize extremely low vacancy rates, Vermont will need 30,000-40,000 more year-round homes by 2030. This means adding 5,000 to 6,700 more homes to Vermont's primary home market each year, well above the 2,100 homes that the state has been generating.

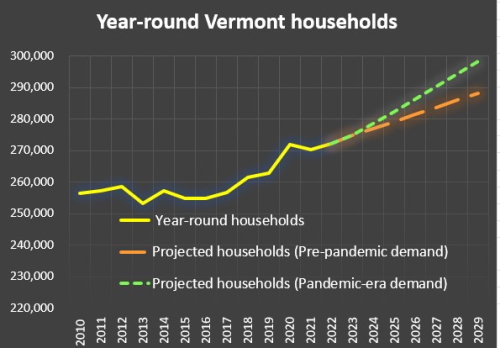

According to the 2020 Census count, the number of primary Vermont households was 9,000 more than in the prior year—an unprecedented increase. Although tempered somewhat in 2021, Vermont continued to show signs of heightened demand.

The two sets of projections reflect different strategies for planning Vermont’s future: planning for lower (pre-pandemic) or higher (pandemic-era) rates of household growth.

Did Vermont's population jump in 2020?

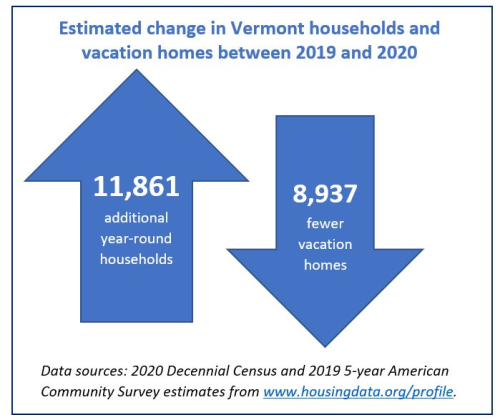

According to the Census Bureau's 2020 count, 17,336 more people and 15,448 more households considered Vermont their primary home than in 2010, despite earlier predictions of near zero growth in the statewide tally. This was almost certainly the result of the COVID-19 pandemic that abruptly shifted the way we lived and worked in 2020.

Vermont home prices continue to increase despite predictions of cooling market

The median Vermont primary home sold for $295,000 throughout the first six months of 2022, compared to $270,000 throughout 2021, a 9.3 percent increase for the first half of the year. The median single family non-vacation home sold for $300,000, the median condominium sold for $286,250 and the median manufactured home sold for $130,000.

New data shows how Vermont towns balance jobs and homes

Towns with sufficient homes to house the employees that work there are more likely to make inroads against climate change and the housing affordability crisis. According to data published this week by the Vermont Housing Data website, the top Vermont town with over 10,000 workplaces to strike this balance is Essex. For every 100 homes in Essex, the town has 112 jobs.

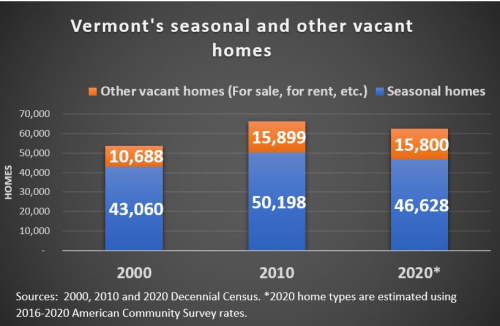

Understanding Vermont’s vacant homes

A recent article in the New York Times suggested that Vermont is ranked first in the nation in vacant homes. This may be surprising to many Vermonters, given the state’s extremely tight housing market. Diving into the data more closely shows that the vast majority of Vermont’s vacant homes are seasonal or vacation homes, which are considered to be vacant under the Census Bureau’s methodology, but not necessarily available to buyers or renters. Vacation homes have been prominent in Vermont’s housing stock for decades due to the state’s ski resorts and long-time desirability among tourists.

Report shows renters face continued challenges post-pandemic

This article was written by VHFA Spring Housing Fellow Christina Cramer

The Joint Center for Housing Studies of Harvard University recently published its annual report, America’s Rental Housing 2022, which thoroughly examines all aspects of the rental housing market. The study detailed the demographics of rental housing, rental housing stock, the rental markets, rental affordability, and the challenges associated with rental housing. The study suggests that federal support associated with the pandemic relief was beneficial to helping families remain in their homes, but finds that renters continue to face significant affordability challenges.