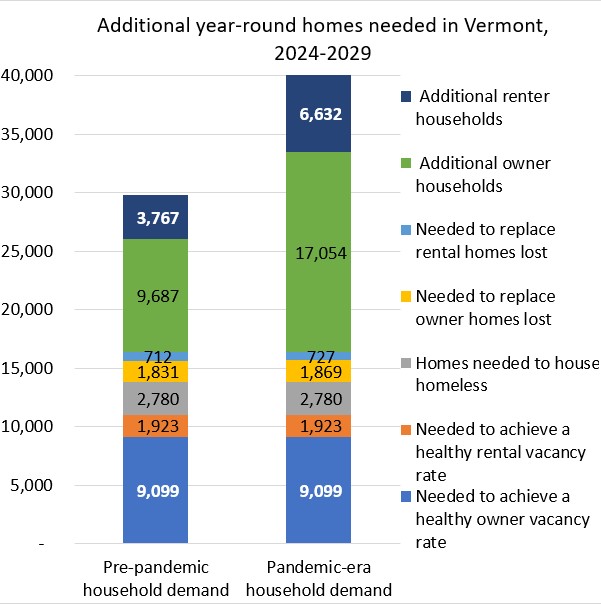

To meet expected demand and normalize extremely low vacancy rates, Vermont will need 30,000-40,000 more year-round homes by 2030. This means adding 5,000 to 6,700 more homes to Vermont's primary home market each year, well above the 2,100 homes that the state has been generating.

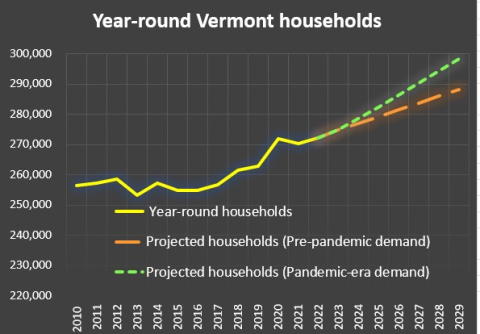

According to the 2020 Census count, the number of primary Vermont households was 9,000 more than in the prior year—an unprecedented increase. Although tempered somewhat in 2021, Vermont continued to show signs of heightened demand.

The two sets of projections reflect different strategies for planning Vermont’s future: planning for lower (pre-pandemic) or higher (pandemic-era) rates of household growth.

The economic lesson of demand outweighing supply is playing out clearly in housing market indicators and in the lives of lower- and middle-income households, especially for renters and home buyers. Vacancy rates are at extremely low levels both statewide and in Chittenden County while rent and home sales price increases accelerate.

The lower a household’s income and wealth, the less likely they are to find a decent, affordable Vermont home to remain in over the long run. The number of Vermonters experiencing homelessness increased steadily in 2019-2022, according to the state’s annual point-in-time count. Renters and homebuyers with higher levels of wealth and income are much more likely to be able to pay higher housing prices.

Source: VHFA analysis of U.S. Census Bureau data (Building Permits, Housing Completions, American Community Survey 1-year estimates, Population and Housing Unit Estimates and Current Population Survey/Housing Vacancy Survey) and the Vermont Coalition to End Homelessness and the Chittenden County Homeless Alliance 2022 Point-In-Time Count of those Experiencing Homelessness. “Pre-pandemic demand” assumes that household demand increases by 0.8% per year. “Pandemic-era demand” assumes that household demand increases by 1.4% per year. Assumes a target vacancy rate of 5% and annual housing destruction rate of 0.15%.