The median Vermont primary home sold for $295,000 throughout the first six months of 2022, compared to $270,000 throughout 2021, a 9.3 percent increase for the first half of the year. The median single family non-vacation home sold for $300,000, the median condominium sold for $286,250 and the median manufactured home sold for $130,000.

Home prices tend to have seasonal cycles, with the largest number of sales and the largest median price increases occurring in spring and early summer, with prices slightly decreasing through the fall and winter. However, since 2020, Vermont has seen more dramatic seasonal shifts and a substantial overall trend towards higher prices.

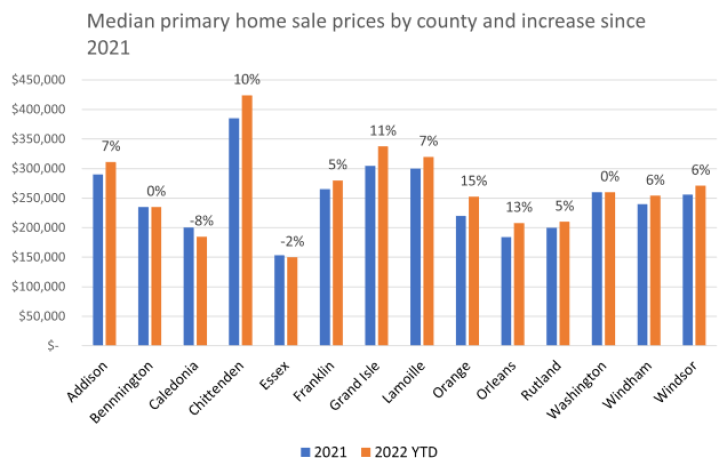

Chittenden County continued to have the highest home prices in the state, with the median primary home selling for $424,175, a 10 percent increase compared to prices throughout 2021. Prior to the pandemic, the largest annual home sale price increases had tended to occur in and around Chittenden County, the state’s largest job center. Throughout the pandemic, the largest price increases occurred in Caledonia, Essex, and Lamoille Counties, and particularly across the state’s resort areas. This shift in home price gains may signal a return to pre-pandemic conditions as many workers return to job sites.

Many national housing market experts are predicting a housing market downturn in the near future, as increased mortgage interest rates cool homebuyer demand and the market corrects itself in response to the inflated home prices experienced during the pandemic. Nationally, the number of home sales appears to be declining, with data from Redfin showing 17.4 percent fewer sales in June compared with the prior year. Vermont had 3,088 primary homes sold in the first half of the year, 22 percent fewer than during the same period in 2021. However, neither national nor Vermont median home sale prices have yet shown a sustained decline so far this year.

Most experts suggest that a housing market bubble or crash like the one in 2007, associated with the Great Recession, remains unlikely. In addition to stricter mortgage underwriting standards that have reduced the number of risky loans that could lead to mass defaults, the nation is still experiencing very low vacancy rates due to a substantial, long-term shortage of homes for sale and for rent. This means that even if demand among homebuyers were to decrease significantly due to higher mortgage rates or a general economic downturn, the pent-up demand among buyers and renters for homes is expected to keep home sale prices from crashing in most parts of the country.

The median Vermont home was listed on the market for 58 days in June, which is the fastest homes have sold since at least 2012. This suggests that for now at least, the state continues to experience strong demand among homebuyers.

Vermont Housing Finance Agency (VHFA) programs are available to help moderate-income Vermonters have an opportunity to become homeowners. In addition to its affordable mortgage and down payment assistance programs, VHFA will soon launch its Missing Middle initiative that will provide subsidies and incentives for homebuilders to construct or rehabilitate modest homes affordable to homebuyers at 120% Area Median Income (AMI) or lower.