Vermont Housing Finance Agency (VHFA) is seeking a Manager of Business Development for its Homeownership programs.

Governor approves down payment assistance increase

Last week, the state increased funding for affordable homeownership when Governor Phil Scott signed a bill passed by the Legislature which will add over a million dollars for homeowners in Vermont.

Survey highlights concerns over housing affordability among young professionals

The annual Burlington Young Professionals (BYP) survey conducted by the Lake Champlain Regional Chamber of Commerce reveals that 33 percent of young adults surveyed plan to move out of the area within the next four years. Among the most common challenges cited were the high cost of living, lack of job growth opportunities, and a lack of affordable housing.

Vermont homebuyers can receive up to $2,000 in tax credits with VHFA

Great news! A Mortgage Credit Certificate provides a mortgage interest tax credit benefit for homebuyers whether or not deductions are itemized.

A Mortgage Credit Certificate is a federal tax credit for up to $2,000 and unlike a tax deduction, a Mortgage Credit Certificate reduces federal tax liability dollar for dollar for homebuyers.

Record Vermont home prices highlight affordability concerns

Vermont home prices reached new highs in 2018, continuing a four year trend of growth. However, household incomes have not kept pace, making it increasingly difficult for low and middle-income Vermonters to become homeowners.

2018 VHFA Single Family Homeownership Program Top Performers

VHFA is pleased to announce the 2018 Top Performers across the local Vermont banks, credit unions and mortgage companies who participate in the VHFA single family homeownership program. VHFA's participating lenders are essential to meeting VHFA's mission to provide homeownership opportunities for low to moderate income Vermont households.

New England Federal Credit Union gives $500,000 for affordable homes in Northwest Vermont

New England Federal Credit Union (NEFCU) President/CEO John J. Dwyer, Jr. announced today a $500,000 grant from NEFCU to Vermont Housing Finance Agency (VHFA) to address the area’s shortage of housing affordable to Vermonters with low and moderate incomes. The money will support construction and renovation costs for perpetually affordable homes in Bristol, Jericho and several other towns.

Vermont Housing Finance Agency wins national award for using state housing tax credits to help home buyers

This week Vermont Housing Finance Agency (VHFA) received national recognition for pioneering the use of state housing tax credits to provide down payment assistance to low- and moderate-income Vermonters.

New research shows path to affordable, sustainable homeownership

A recent report from researchers at Ohio State University and Fannie Mae describes new evidence of ways to extend homeownership sustainably. Lower income households seeking to purchase homes face many barriers including lack of wealth for down payment. Further, “after purchasing a home, lower income homeowners are often at higher

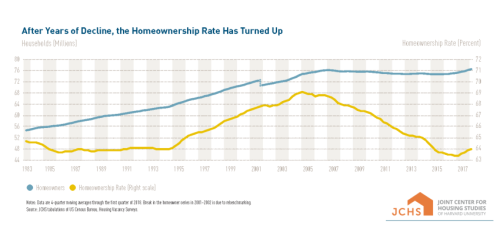

Homeownership rate increases, but first-time buyers face barriers

The annual report on housing from the Joint Center for Housing Studies of Harvard University (JCHS) reveals that although homeownership rates are beginning to climb, young adults are finding it increasingly difficult to afford to buy their first home. The report found that from 1990 to 2016 the median home price rose 41 percent faster than overall inflation, outpacing wage growth during the same period.