The economic recovery is being felt among many households, with home equity wealth rising and more Millennials becoming homeowners. However, gains in homeownership have not been equally distributed among all Americans. Homeownership among black households has risen at a slower pace any other group, and the rate is currently the lowest it has been since 1970.

While America’s homeownership rate is still well below pre-Recession levels, homeownership has been generally increasing since it hit a multi-decade low point in 2016. From 2016 to the end of 2018, homeownership among white households grew by 1.1 percent, to 73 percent overall, while black homeownership increased by only 0.7 percent, to 42.9 percent overall. All other racial groups saw higher increases in homeownership than black households.

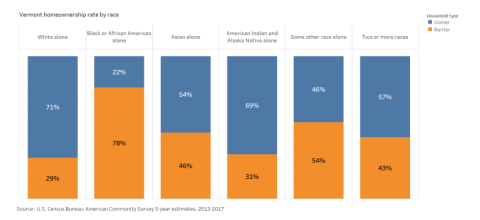

This disparity between black and white homeownership is even more pronounced in Vermont. 71 percent of white Vermonters are homeowners, while only 22 percent of black Vermonters own their own home. Both in Vermont and nationwide, black households trail all other racial groups in homeownership rates.

The slow gains in homeownership among black households is discouraging, particularly since national data shows black households lost much more wealth than white families during the Recession. Prior to the Recession, many lenders disproportionately targeted black borrowers for subprime mortgages nationwide. Black households were more likely to have a greater portion of their wealth invested in their homes, which combined to hit these households harder when the market collapsed. Homes in majority-black neighborhoods lost more value during the housing market collapse, with even high-income black neighborhoods 14 times more likely to have experienced falling home prices than other areas.

The homeownership rate among black households is currently the lowest it has been since at least 1970, when the Census Bureau began to keep reliable records. The Fair Housing Act (FHA), which protects people from discrimination when buying a home or applying for a mortgage, was passed in 1968. All the gains in black homeownership since that time were erased during the Great Recession.

As mortgage interest rates remain low and the employment rate continues to increase, we would expect homeownership rates to rise among all groups. However, Vermont home prices are currently too high for many middle-income households to afford. The next recession could erase even the modest gains in homeownership Vermont has seen so far.

What can be done to improve homeownership rates, especially among black households? More and more states and cities are investing in alternative solutions to homeownership, such as Vermont’s robust shared equity programs available through the Neighborworks Alliance of Vermont. In addition, increased funding for homeownership programs that lend to underserved households can help young, low and moderate-income households afford their first home. VHFA’s ASSIST program offers up to $5,000 in down payment assistance, which can often be one of the most significant obstacles to homeownership, and is funded by state tax credits.