On Thursday, the Vermont Housing Finance Agency (VHFA) Board of Commissioners awarded Vermont State Affordable Housing Tax Credits for developing rental and for-sale homes across the state. Once they are sold to investors, the credits will yield over $4.8 million in equity to fund construction and substantial rehabilitation of 246 rental and for-sale homes and support the statewide Manufactured Housing Downpayment Program for approximately 41 homes. This program provides downpayment assistance for Zero Energy Modular and energy-efficient manufactured homes.

In considering this year’s awards, commissioners confronted the ongoing increase in housing costs, increased demand for affordable rental and single-family homes as well as an increase in homelessness. Applications for State Affordable Housing Tax Credits outpaced available credits, leaving VHFA looking for creative approaches to move more projects forward. By supplementing the credits with innovative, flexible funding such as the Local Advisory Investment Committee (LIAC) program, also known as “10% In Vermont,” through the Vermont Treasurer's Office and the Vermont Housing Investment Fund (VHIF), VHFA was able stretch the impact of state resources to maximize access to safe, decent, affordable housing.

“The Vermont State Affordable Housing Tax Credits have become a vital part of our housing finance toolbox,” said VHFA Executive Director Maura Collins. “By tapping newer, innovative financing options like LIAC and VHIF, as well as existing, but under-utilized, tools like federal Low-Income Housing Bond Tax Credits, we’ve been able to make the precious state resources provided through housing credits go much further.” Collins went on to add, “With so much focus on building new homes, and understandably so, we also directed some of this year’s awards to existing affordable homes, protecting Vermont’s investments and ensuring accessible, affordable housing into the future.”

Created in 2000 and expanded several times since, the Vermont State Affordable Housing Tax Credit was created by the Vermont legislature to support the development of affordable rental and for-sale homes, including energy-efficient manufactured homes and Zero Energy Modular homes. The state credits are also used to support down payment assistance for low and moderate-income home buyers. VHFA expects the credits to help approximately 200 first-time home buyers in 2024 by providing assistance of up to $10,000.

Projects and programs receiving 2024 State Affordable Housing Tax Credit awards include:

- Cambrian Rise rental homes and condominiums in Burlington, developed by Champlain Housing Trust and Evernorth. The project will include 40 newly constructed rental homes, eight of which will be for those exiting homelessness. It will also include 30 newly-built for-sale condominiums.

- East Creek Commons in Rutland and Castleton, developed by the Housing Trust of Rutland County, involves the construction, preservation and rehabilitation of 35 homes, eight of which will be for people exiting homelessness.

- Hedding-Church-Forest in Randolph, developed by Randolph Area Community Development Corporation, involves the rehabilitation of four buildings and the construction of one new building focusing on energy efficiency upgrades and deep affordability for those at or below 50% Area Medium Income (AMI). Of the 32 apartments in this project, 5 will be for people exiting homelessness.

- Arlington Village Center in Arlington, developed by Shires and Evernorth, will include the preservation and improved accessibility of 30 restricted rental homes and improve accessibility.

- Whitcomb Woods in Essex Junction, developed by Cathedral Square, will include the preservation and increased accessibility of an existing 64-unit, age-restricted rental property that utilizes a project-based rental contract. All units are affordable for those at or below 50% AMI.

- Salisbury Square Phase 2 located in Randolph, developed by Randolph Area Community Development Corporation, includes nine newly constructed, highly-efficient and solar-powered for-sale homes.

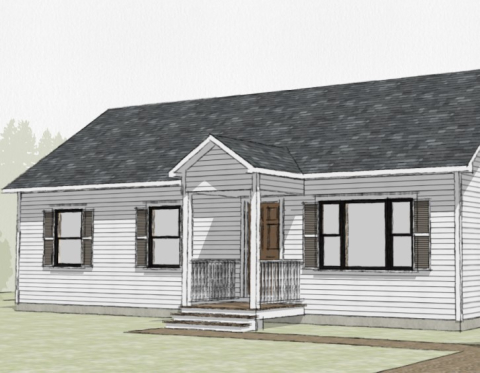

- Heaton Street in Montpelier, developed by Downstreet Housing, will include four newly built, net-zero, three bedroom for-sale homes.

- Wright Court in South Burlington, developed by Champlain Housing Trust and Green Mountain Habitat for Humanity, will be a duplex and include one 2-bedroom and one 4-bedroom for-sale homes.

- Hall Street in Winooski, developed by Champlain Housing Trust and Green Mountain Habitat for Humanity, will include the demolition of a single existing, unstable house and the construction of triplex.

State Affordable Housing Tax Credits were also awarded to the Statewide Manufactured Housing Downpayment Program, operated by Champlain Housing Trust. This long-standing and successful program provides downpayment assistance for the purchase of Zero Energy Modular (ZEM) and energy-efficient manufactured homes throughout the state.

Last week’s round of State Affordable Housing Tax Credits awards will leverage a variety of other resources for the projects from federal, state, municipal, and private funding streams.

Photo: Rendering of a proposed 3-bedroom home on Heaton Street in Montpelier courtesy of Downstreet Housing.