A new report from the Federal Reserve Bank of Boston estimates that job losses related to the COVID-19 pandemic could put 21,351 Vermont homeowner and 23,561 renter households at high risk of not being able to pay their mortgage or rent.

Although many Vermonters will feel the economic impact of the pandemic, workers in occupations with greater risk of layoffs and furloughs are especially likely to have difficulty paying for housing. This includes jobs categorized as nonessential, cannot be done from home and are paid hourly. In Vermont, a large number of these jobs are likely to be located in the leisure, tourism and hospitality sectors.

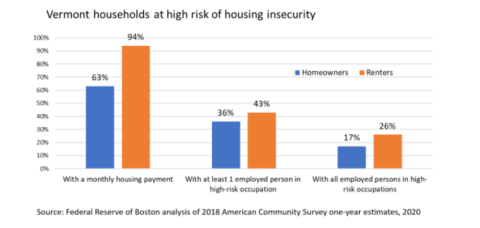

According to the Federal Reserve’s analysis of Census data, 36% of Vermont homeowners have at least one member in a high-risk occupation, including 17% that have all members in high-risk occupations. The share of renters at high risk is even greater, with 43% of households with at least one high-risk worker, and 26% with all members in high risk occupations.

Homeowners are more likely to be able to weather the economic impact of the pandemic than renters. Sixty three percent of Vermont homeowners have a monthly housing payment (in the form of a mortgage), compared to 94% of renters. Homeowners are also more likely to have savings and to have other non-earnings income in the form of retirement, investments, Social Security or welfare payments. The Federal Reserve estimates that 32% of Vermont renters could not afford their monthly rent if all members working in high-risk jobs became unemployed and did not have access to government assistance, compared to just 11% of homeowners.

It remains unknown how many at-risk households will actually become unemployed, and how long job losses will persist. At Vermont’s highest recent unemployment level to date, over 81,000 Vermonters filed for benefits. The number of weekly Vermont unemployment claims has been declining since the week of April 25, although it is not yet clear whether this is due to workers becoming reemployed, businesses obtaining access to PTT loans to temporarily pay workers or lingering administrative delays related to benefits processing.

The Federal Reserve suggests that emergency payments under the federal CARES Act combined with state-level eviction and foreclosure moratoriums may substantially mitigate the impact of New England job losses. Under their best-case analysis, if 95% of eligible Vermont households receive stimulus and unemployment payments, 1.9% of homeowners and 6.8% of renters would be at high risk of nonpayment.

However, supplemental unemployment under the CARES Act will expire at the end of July. Unless most workers are able to return to work by that time, or the federal government provides additional funding, non-payments resulting from job losses may simply be deferred until later in the summer. The Federal Reserve estimates that without federal assistance, missed mortgage and rent payments in Vermont could total up to $48 million per month, which could have a large impact on Vermont’s housing market and economy as a whole.