Stakeholder input needed for roadmap to end homelessness in Vermont

A steering committee of housing and service providers, state agencies and funding organizations is working to reduce homelessness and stabilize vulnerable populations. The committee’s current goal is to develop a system for facilitating service-connected affordable housing options, building local capacity, determining costs and identifying available and needed resources.

Vermont Affordable Housing Coalition launches storytelling project

Interviews with residents of subsidized rental housing in Vermont will be the core of a new story telling project launched by the Vermont Affordable Housing Coalition.

The first interview shared through the project is with Angela Devoid, a single mother living at Moose River Apartments in St. Johnbury. Listen to her story.

The critical, and mathematical, role of tax credits and other sources in housing low-income Vermonters

Ever wonder why it's not easier to build affordable apartments? A new interactive tool developed by the Urban Institute illustrates the mathematical necessity of tax credits, loans, tenant income/rent and grants in paying for the costs of affordable housing. Check it out to see if you can make the math work!

Housing tax credits help renovate Lyndonville's Darling Inn

office), Werner Heidemann (RuralEdge), Senator Leahy, Jen Hollar

(VHCB) and Sarah Carpenter (VHFA). Photo by Elwin Prescott.

VHFA AND UNION BANK TURN TAX CREDITS INTO DOWN PAYMENT HELP FOR VERMONTERS

By purchasing $125,000 in Vermont Housing Tax Credits last Friday, Union Bank supplied the equity needed to help approximately 125 households buy their first homes in Vermont this coming year. These households will receive up to $5,000 to help cover their down payment and closing costs through a statewide program when they qualify for a Vermont Housing Finance Agency mortgage.

Affordable housing tops concerns in UVM Medical Center community survey

Lack of affordable housing is the community challenge that survey respondents are most concerned about, according to the recently released 2016 Community Health Needs Assessment. Among survey respondents, 58.3 percent rated lack of affordable housing as the top concern, followed by 52.5 percent for drug and alcohol abuse.

Chittenden County leaders call for increased production of housing over next 5 years

Building Homes Together was launched yesterday. It is a collaboration of organizations and communities seeking to remedy some of the most pressing challenges in Chittenden County’s housing market.

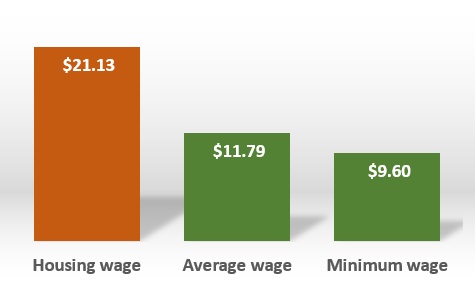

High rents put Vermont’s housing wage far above average wage or minimum wage

A modest, two-bedroom apartment costs $1,099, according to the annual Out of Reach report from the National Low-Income Housing Coalition.

A modest, two-bedroom apartment costs $1,099, according to the annual Out of Reach report from the National Low-Income Housing Coalition.

Bipartisan Policy Center recommends new funding and approaches to meet housing needs of seniors

A recent report from the Bipartisan Policy Center describes the need for a comprehensive national approach to integrating health care and housing for sen