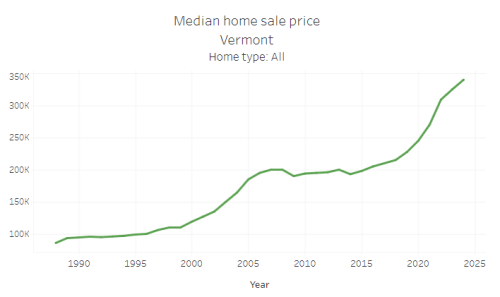

New Vermont Property Transfer Tax (PTT) data shows recent trends in the home sale market have continued in the first half of 2024. During that time, the median sale price of year-round homes increased an additional 5%, compared to the median price of $325,000 in 2023. At the same time, the median length of days a Vermont home is on the market for sale has remained at a historic low point, suggesting demand to buy homes in Vermont remains high despite increasing sale prices.

Join us for a free one-hour webinar to learn about the homebuying process, how to qualify for a mortgage, special assistance programs that could help, and where to get started!

Mascoma Bank joins VHFA Participating Lender Network

VHFA is pleased to announce Mascoma Bank has joined as a participating lender and is now offering VHFA programs and benefits to eligible homebuyers.

Community National Bank joins VHFA Participating Lender Network

VHFA is pleased to announce Community National Bank has joined as a participating lender, and is now offering VHFA programs and benefits to eligible homebuyers. Community National Bank brings a wealth of mortgage lending expertise and has been rooted in Vermont since 1851.

Pandemic assistance program awards $41 million to help homeowners

Over $41 million has been paid on behalf of 5,800 Vermont homeowners to help them stay housed during the pandemic, thanks to the Vermont Homeowner Assistance Program (VHAP). The program helped pay for overdue mortgage, property taxes, and utility bills.