Vermont Housing Finance Agency (VHFA) has issued a Request for Information from firms qualified to perform services to inform the Agency's design and implementation of its Solar for All Program (SFA). Proposals must be submitted no later than 5:00 pm (EDT), on July 11, 2025.

New Senior Housing Celebrated in Hinesburg with Kelley's Field II

Hinesburg took a big step forward in becoming a part of the senior housing solution with the ribbon cutting and celebration of Kelley’s Field II on June 4th. The addition of 24 new and affordable apartments comes after two years of planning and waiting according to stakeholders who gathered for the community event. The site of the new apartments is adjacent to the 24 apartment-project called Kelley’s Field I.

Groundbreaking for Affordable Housing in Rutland Highlights Community Support for Vulnerable Residents

The Rutland community celebrated the groundbreaking of Maplewood Commons Apartments on May 21st. The event signifies the new construction of 30 permanently affordable homes near Rutland’s city center.

Construction of New Affordable Apartments in Putney Gets Underway

A long-awaited groundbreaking ceremony took place in Putney on May 5th for the Alice Holway Drive development. The development will include 2 new buildings that provide 25 energy-efficient, accessible, and affordable apartments.

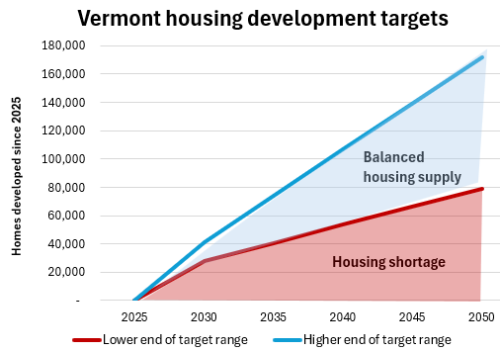

Housing targets illuminate path to balancing Vermont’s housing supply

In January the Vermont Department for Housing and Community Development published statewide and regional targets that provide a pivotal opportunity for Vermont communities to address housing shortages. Derived from the recent statewide housing needs assessment, these targets indicate that Vermont’s housing supply will meet expected demands if it increases by 28,000-41,000 homes by 2030.

Fair Housing Month in Vermont Promotes Awareness with Free Community Events

April is Fair Housing Month and the Vermont Housing Finance Agency (VHFA) is excited to join community advocates and housing partners in Vermont to commemorate the 1968 passage of the Fair Housing Act.

Surveys to help guide Vermont housing policy and planning

The State of Vermont’s Department of Housing and Community Development (DHCD) is inviting the public to complete a survey on community needs to inform its upcoming HUD Consolidated Plan. Your input will assist the DHCD in developing a new five-year Consolidated Plan for 2025-2029, as required by the U.S. Department of Housing and Urban Development (HUD).

Celebrating 50 years of impactful partnerships

Earlier this month VHFA celebrated its 50 year history by honoring the community of partners and current and former staff intrinsic in VHFA's work. At an evening gathering at HULA in Burlington on Lake Champlain, VHFA Board of Commissioners chair Katie Buckley thanked the mortgage lenders, housing developers, lawmakers, state agency partners, financial institutions and advocates needed for VHFA to carry out it's mission.

Rick DeAngelis and Julie Bond selected as 2024 Vermont Housing Heroes

Last week the Vermont Statewide Housing Conference recognized the contributions of Julie Bond and Rick DeAngelis of Good Samaritan Haven by selecting them for this year’s Vermont Housing Hero award. Good Samaritan Haven is a non-profit providing emergency assistance to people experiencing homelessness in Central Vermont.

New resource guide describes employer-assisted housing options

Although employer-assisted housing has a long history in the U.S., the recent housing shortage has prompted new interest in this strategy for meeting the housing needs of Vermont workers.