Two new reports show that rental housing in Vermont is unaffordable for many workers, not only for those earning minimum wage, but also for skilled middle-income workers.

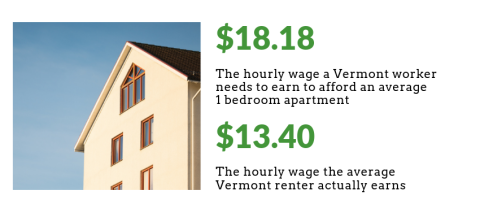

Out of Reach: The High Cost of Housing, the annual report from the National Low Income Housing Coalition (NLIHC) and the Vermont Affordable Housing Coalition (VAHC), reveals that a Vermont worker would need to earn $18.18 per hour to afford a one-bedroom apartment. This figure is known as the Housing Wage, the hourly wage a household must earn while working full time to afford a decent apartment at fair market rent, while spending no more than 30% of their income on housing expenses. Most renters earn far less than that amount, with the average Vermont renter earning just $13.40 per hour.

Finding affordable housing is even more difficult for workers earning the minimum wage of $10.78. No Vermont county has fair market rents even for the smallest, studio apartments that are affordable for minimum wage workers. In the greater Burlington area, which has the highest housing prices in the state, a minimum wage worker would need to work nearly 64 hours per week to afford a studio apartment.

The full data on 2019 fair market rents and Housing Wages has been added to the Community Profiles on HousingData.org, a free housing information resource managed by VHFA. The site also features a database of the state’s subsidized rental housing, which helps low-income Vermont households find apartments that they can afford.

While the affordable housing shortage hits minimum wage workers the hardest, housing affordability is a challenge for even moderate-income Vermont workers. The National Housing Conference’s (NHC) Paycheck to Paycheck report finds that wages for many jobs would not be enough to afford rent for a one bedroom apartment in the Burlington metro area, including child care workers, home health aides, security guards and bank tellers.

Many skilled workers, like carpenters, police officers, teachers, mechanics and registered nurses could afford rent for a small apartment, but would not be able to afford a larger apartment suitable for a family or down payment on a house on their incomes alone. Although many workers might be part of two-earner households, which would expand their purchasing power, the report doesn’t take in account the high cost of childcare and student loans, which can easily exceed a worker’s entire salary.

It is clear the housing market in Vermont is failing to meet to the needs of many households. One solution to this problem is more housing. Vermont’s low rate of housing development over the past two decades has led to low rental vacancy rates and low inventories of home for sale, both of which tend to drive up prices. To reverse this trend, Vermont will need to remove regulatory barriers that inhibit housing development as well as investing more resources in subsidized housing programs.