Last week, VHFA Executive Director Maura Collins spoke on a housing panel at the Vermont Economic Conference in Burlington. She was joined by Jonathan Slason of Resource Systems Group, Inc. and moderator Leslee MacKenzie of Coldwell Banker Hickok & Boardman Realty.

Collins and Slason emphasized the fact that housing is a significant part of Vermont’s economy, typically accounting for 15-18% of Vermont’s GDP, which was $32.5 billion in 2017. This includes construction and remodeling of homes, real estate activities, rents, and utilities paid by homeowners and renters. Collins described how a community’s housing stock can produce additional economic benefits for local businesses if it provides opportunities for employees to live near their jobs and spend no more than a third of their income for housing.

Collins discussed how the wages of top-growing occupations in Vermont are not high enough to afford prevailing housing prices. Wages continue to stagnate both in Vermont, even as rents and home prices increase. Food preparers, personal care aides, and RNs have the largest number of of new jobs in the state in recent years, yet none of these occupations have a median wage high enough to afford to buy a median-priced Vermont home.

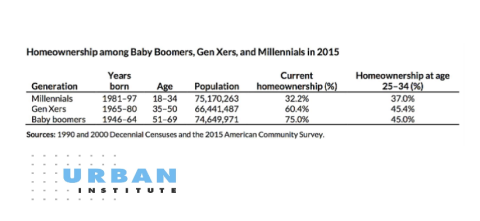

Of particular concern is the millennial generation, which has now entered peak homebuying ages of 25 to 34. A recent report from the Urban Institute finds that the national homeownership rate of millennials in this age group was 37 percent in 2015, which is 8 percent lower than the homeownership rate of Gen Xers and baby boomers when they occupied that age bracket. The Urban Institute estimates that if the homeownership rate for millennials had stayed the same as previous generations, there would be 3.4 million more homeowners today. The report suggests that the most common causes are delayed marriage, high levels of debt, and a greater share of the population living in high-cost areas.

Vermont’s population growth is essentially flat, particularly among young households. High housing costs may be a significant factor preventing the state from attracting and retaining millennials. This has ripple effects across the entire economy, including making it difficult for employers to bring skilled workers to our area.

Fortunately, Vermont Housing Finance Agency’s homeownership programs can help young households afford their first home. VHFA’s ASSIST program offers up to $5,000 in down payment assistance, which can often be one of the most significant obstacles to homeownership.

Slides from the presentation are available on VHFA's website.