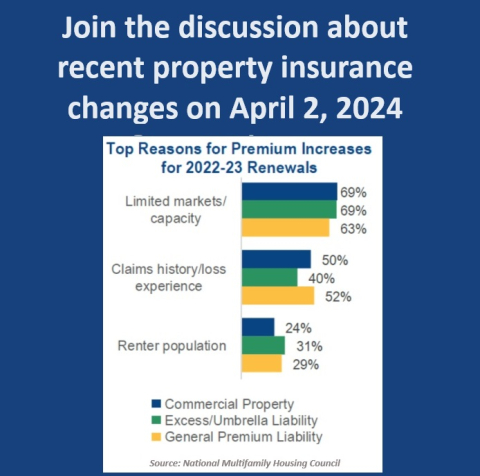

Seventy-five percent of affordable multifamily housing developments surveyed nationally reported insurance premium hikes over 10% between 2022 to 2023 according to a National Multifamily Housing Council report. Bloomberg and other news outlets have been reporting how “rising insurance rates are crushing affordable housing” which led to a Senate Committee hearing in Congress last year.

Affordable housing in Vermont is facing these same challenges and so the Vermont Housing Finance Agency is inviting affordable housing owners, managers, developers, including Public Housing Authorities, nonprofits and for-profits to a webinar on the topic to be held April 2nd from 1 to 3 pm via Zoom.

Agenda

- Welcome – Maura Collins (Vermont Housing Finance Agency)

- Presentation on national trends and what’s driving them from an insurance perspective – Thom Amdur (Lincoln Avenue Communities)

- Presentation on impacts of recent insurance changes on Evernorth’s three-state portfolio – Sherrin Vail (Evernorth)

- Presentation on the tools and resources Champlain Housing Trust uses to manage risk and responses – Michael Monte (Champlain Housing Trust)

- Overview of possible steps Congress, the White House, and the Vermont Legislature could consider to address impacts – Thom Amdur

- Open discussion among Panelists to discuss what properties can do to manage risk, lower costs, or respond to new challenges – facilitated by Andrew Winter (Twin Pines Housing Trust)

- Audience questions and discussion – facilitated by Andrew Winter

This will be recorded and published on VHFA’s website following the event.

This meeting will be held via Zoom at https://us06web.zoom.us/j/85691784244?pwd=NDauoTLfScIYBgu2QeeEwJKzLEI5AW.1

Meeting ID: 856 9178 4244

Passcode: 259086

To call in dial 309-205-3325 and use meeting ID and passcode above.