Vermont Housing Finance Agency (VHFA) has announced an expansion of the Vermont Mortgage Assistance Program in order to assist more Vermont homeowners who have fallen behind on their mortgage and are facing economic hardship brought on by the COVID-19 pandemic.

Mortgage Assistance Program webinar on July 23

Vermont Legal Aid will host a free, 30-minute virtual town hall on Thursday, July 23 at 10 a.m. It will discuss the new financial help homeowners affected by COVID-19 can receive through the Vermont Mortgage Assistance Program as well as other programs for homeowners who may be facing foreclosure.

$5 million in mortgage assistance will help Vermont homeowners hurt by pandemic

Vermont’s new Mortgage Assistance Program was announced today to help low-income homeowners who have fallen behind on their mortgage and are facing economic hardship brought on by the COVID-19 pandemic. The program will provide up to three monthly mortgage payments directly to the servicer of the mortgage with a goal of preventing future foreclosure.

Helping homebuyers stretch their buying power in uncertain times

This article previously appeared as sponsored content on VTDigger. VHFA is proud to underwrite VTDigger’s independent journalism.

VHFA Homebuyer Webinar Wednesday, June 17, 2020 - JOIN US!

Homebuyers - especially first-time homebuyers - usually have questions about where to start and where to find special programs. To answer these and other questions, VHFA is hosting a one-hour webinar to explain how VHFA programs can help eligible homebuyers. Topics will include:

Housing resources during the COVID-19 outbreak

VHFA is aware that many homebuyers, current homeowners, and property owners may have questions and concerns about buying a home or paying their mortgage during the COVID-19 outbreak. To address these issues, VHFA has compiled a list of resources:

For homebuyers

VHFA continues operations during COVID-19 outbreak

In the midst of the unprecedented outbreak of COVID-19, VHFA is committed to continuing to provide excellent service to its partners while also safeguarding the health of its staff and of the community. To that end, as of this week, VHFA will be limiting the number of staff in our office. The majority of VHFA staff will be working from home. Our staff responses may be slightly delayed due to the change in conditions, and we appreciate your patience as we adjust.

By reducing rates to historic lows, VHFA expands homebuying opportunities statewide

This week marked VHFA’s offering of the lowest interest rates in the agency’s history for Vermont homebuyers. Rates as low as 3.0% became available on 30-year mortgages made through VHFA’s programs, available exclusively through its statewide network of participating lenders.

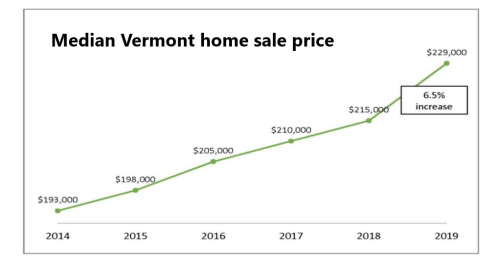

Vermont home sale prices increase by 6.5% in 2019

The median Vermont primary home sold for $229,000 in 2019, according to Property Transfer Tax records, a 6.5% increase from 2018. This is the largest single year increase in median home prices since before the Recession, and a substantial increase over recent years’ home price growth. Since 2014, Vermont median home prices have increased by an average of 2.7% per year.

Homeownership declines among young Vermonters

This commentary by VHFA Executive Director Maura Collins appeared recently in VTDigger