The number of homeless living in the U.S. who are over the age of 50 has jumped recently, and now comprises 31 percent of the nation's total homeless population, according to the New York Times.

Bipartisan Policy Center recommends new funding and approaches to meet housing needs of seniors

A recent report from the Bipartisan Policy Center describes the need for a comprehensive national approach to integrating health care and housing for sen

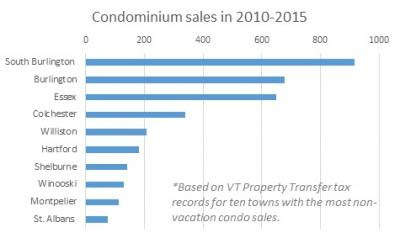

Vermont’s condominium prices remain level between 2010 and 2015

Although most non-vacation condominiums sold each year in Vermont are near Burlington, several towns in other parts of the state also play an important role in this segment of the housing market. About 80 percent of all primary residence condo sales in Vermont each year take place in 10 towns--7 inside Chittenden County and 3 beyond its boundaries.

Metamorphosis begins for once-decaying mobile home park near Vergennes

After sitting vacant for six years, the Gevries mobile home park in Addison County has started redevelopment. VHFA provided housing tax credits that will cover an estimated 60 percent of the project’s costs and ensure that the new 14-home community will be affordable for low-income renters of all ages.