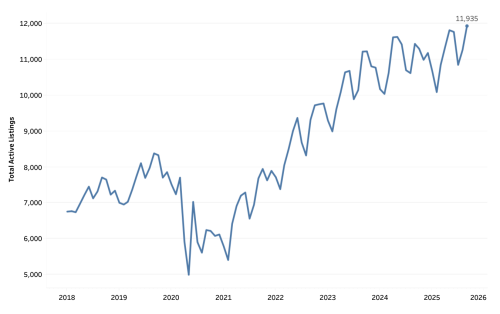

According to recent data published by VHFA on HousingData.org, the median sales price of a primary home in Vermont increased by 7% annually from 2000-2025, reaching $379,000.

Fuel your New Year resolutions with housing data

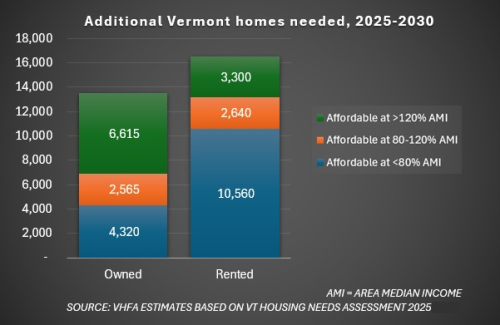

Recent data can help Vermonters make more impactful decisions about how to meet our state’s most urgent affordable housing needs. Early in 2025, the Vermont Housing Needs Assessment demonstrated a need for 24,000-36,000 additional homes over the next five years to close existing gaps and prepare for future households.

Home building counts are key to meeting Vermont housing needs

Vermont needs your help identifying new homes built in your community. Earlier this year, VHFA and the State of Vermont published studies quantifying the new homes needed to address immediate and future housing needs.

VHFA Data Analysis Uncovers New Trends within Vermont Vacation Rentals

New research into Vermont’s short-term rental (STR) market conducted by Vermont Housing Finance Agency (VHFA) has revealed 16,000 distinct whole-unit listings were available during the year between September 2024-2025. This data represents 43,000 total bedrooms (about 4.6% of the state’s housing stock).

Having trouble accessing Census Bureau data?

Census Bureau data has become difficult to access through its main website during the recent government shutdown but continues uninterrupted on housingdata.org. Each year VHFA extracts the most recent estimates gathered by the Census Bureau to ensure continued fact-based decisions about the homes and households in each Vermont community.

Vermont Visitors: New Data on Short-Term Rentals and Vacation Homes

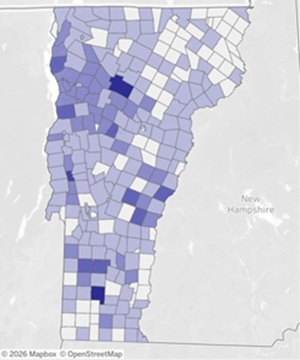

About 12,000 Vermont homes were available to visitors seeking short-term rentals last month, according to new data on housingdata.org through June 2025. Many of these homes are also counted among the state’s 50,000 vacation homes. Vermont’s vacation homes (those used seasonally or occasionally) have consistently comprised about 15% of the state’s entire housing stock.

Comprehensive update of HousingData.org improves public access to Vermont-specific housing resources

VHFA recently completed a comprehensive update of HousingData.org, improving this vital public resource for housing advocacy in Vermont. Since 2003, VHFA’s HousingData.org has been the premier online source for high quality data and research about Vermont’s housing landscape, with all information available for free to the public.

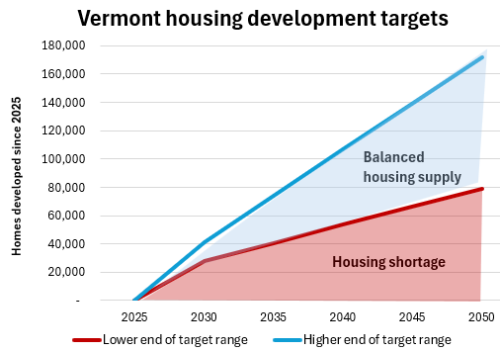

Housing targets illuminate path to balancing Vermont’s housing supply

In January the Vermont Department for Housing and Community Development published statewide and regional targets that provide a pivotal opportunity for Vermont communities to address housing shortages. Derived from the recent statewide housing needs assessment, these targets indicate that Vermont’s housing supply will meet expected demands if it increases by 28,000-41,000 homes by 2030.

VHFA's 2024 Annual Report highlights 50 years of helping Vermont build affordable housing solutions

Vermont Housing Finance Agency (VHFA) has released its 2024 Annual Report (PDF) highlighting 50 years of service to the Vermont community. In recognition of VHFA’s 50th anniversary, the report features the Agency's history of creating and sustaining access to affordable housing opportunities for low- and moderate-income Vermonters.

Increase in Off-Site Construction Examined As Possible Tool to Boost Vermont’s Housing Supply

The Vermont Housing Finance Agency (VHFA), the Vermont Economic Development Authority (VEDA), and the Vermont Agency of Commerce and Community Development (ACCD) are announcing the results of a new study they jointly commissioned that examines the potential of off-site home construction. Off-site construction homes are built in factories, shipped, and assembled at the housing site by the manufacturer.