The Local Support and Community Action Team of the State of Vermont Economic Mitigation and Recovery Task Force needs your help prioritizing high impact ideas and actions identified by diverse stakeholders for COVID-19 recovery. The task force was established by Governor Scott to help mitigate the short-term economic impacts of the COVID-19 pandemic and develop strategies for

Assessing the pandemic’s impact on Vermont communities

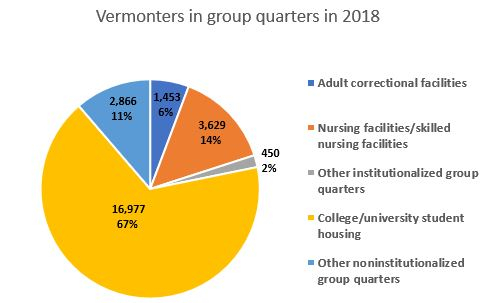

Statewide reports of rising unemployment and residents in nursing homes especially vulnerable to COVID-19 can cause more questions than answers for Vermont’s communities. How many of our residents are unemployed? How many live in “group quarters” and are especially at risk of contagious disease like COVID-19?

Economic impact of coronavirus outbreak on Vermont housing

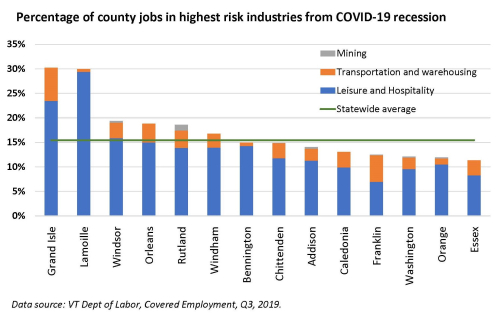

Vermont has received over 71,000 unemployment claims since the coronavirus pandemic reached the state. An economic recession is almost certainly forthcoming.

Updates needed to Vermont's list of vacant subsidized rental homes

To help re-house Vermonters in living quarters rendered unsafe by COVID-19, owners and managers of Vermont's subsidized apartments are encouraged to list all vacancies on the Vermont Housing Data website. In addition to Vermonters who find themselves in need of rental housing, HUD and FEMA both use this vacancy list to coordinate disaster recovery.

LIHTC housing leads to higher incomes and educational attainment

New national research from the Congressional Joint Committee on Taxation finds that children who grow up in housing funded by the Low-Income Housing Tax Credit Program (LIHTC) program are more likely to enroll in higher education programs and have higher earnings as adults.

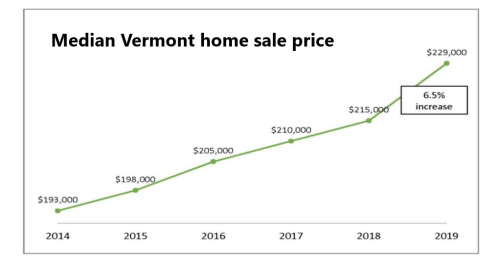

Vermont home sale prices increase by 6.5% in 2019

The median Vermont primary home sold for $229,000 in 2019, according to Property Transfer Tax records, a 6.5% increase from 2018. This is the largest single year increase in median home prices since before the Recession, and a substantial increase over recent years’ home price growth. Since 2014, Vermont median home prices have increased by an average of 2.7% per year.

How the census affects us all

This commentary by VHFA Executive Director Maura Collins appeared recently in VTDigger

Homeownership declines among young Vermonters

This commentary by VHFA Executive Director Maura Collins appeared recently in VTDigger

Vermont Rural Life Survey highlights affordability challenges

VPR and Vermont PBS have released the results of the annual Vermont Rural Life Survey, which polls households from all across Vermont about life in their communities and the daily challenges they face. Vermont has the second highest percentage of its population living in rural areas in the United States.

Impact of Vermont colleges on housing affordability difficult to measure

Fall has started to arrive in Vermont, and with it is the return of many college students to the state. The impact of college students on local housing markets has long been a source of tension, particularly among long-term Burlington residents, who worry they may be priced out of housing by the large number of area students.