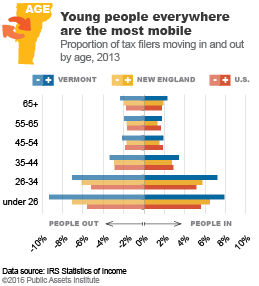

About 4 percent of Vermont's households move out of the state each year, replaced by about the same number of people moving into Vermont, according to a new study of IRS data from the Public Assets Institute. This new data confirms that younger households are the most likely to move, but that those moving out are replaced by about the same number of young households moving into the state.

Housing credit applications due January 29, 2016

VHFA intends to consider new projects for the federal 9% Housing Credit and Vermont State Housing Credits at the April 2016 VHFA Board of Commissioners meeting. In order to provide sufficient time to review the proposals from developers, VHFA must receive a complete application by January 29, 2016.

Moody’s expects VHFA and similar agencies in other states to continue strong performance

A recent report from Moody's Investors Service (Moody's) concludes that HFA financial profiles demonstrated solid improvement in FY 2014.

A recent report from Moody's Investors Service (Moody's) concludes that HFA financial profiles demonstrated solid improvement in FY 2014.

VerMod company creates employment opportunties (and high-efficiency homes)

Steve Davis, owner of the Wilder-based VerMod company is becoming recognized not just for his company's high quality modular homes but for the employment opportunities he has created for residents of the Hartford Dismas House.

Steve Davis, owner of the Wilder-based VerMod company is becoming recognized not just for his company's high quality modular homes but for the employment opportunities he has created for residents of the Hartford Dismas House.

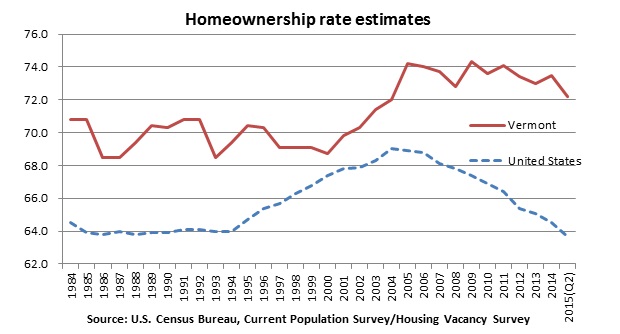

Vermont homeownership rate hovers well above declining U.S. rates

Although Census surveys show a clear decline in the national homeownership rate, they don’t show a similar decline for Vermont. At least not yet. Second quarter 2015 estimates show Vermont’s rate at 72 percent, nearly eight and a half percentage points higher t

Although Census surveys show a clear decline in the national homeownership rate, they don’t show a similar decline for Vermont. At least not yet. Second quarter 2015 estimates show Vermont’s rate at 72 percent, nearly eight and a half percentage points higher t

Student loan balances in two Vermont counties among highest in New England

The average student loan balance is $30,000 among Chittenden and Windsor county residents between the ages of 18 and 44.

The average student loan balance is $30,000 among Chittenden and Windsor county residents between the ages of 18 and 44.

VHFA awards $2.98 million in affordable housing tax credits

On Monday, April 20, the VHFA Board of Commissioners committed $2.55 million in federal low-income housing tax credits and $432,500 in state housing tax credits to expand Vermont’s stock of affordable, energy-efficient housing.

On Monday, April 20, the VHFA Board of Commissioners committed $2.55 million in federal low-income housing tax credits and $432,500 in state housing tax credits to expand Vermont’s stock of affordable, energy-efficient housing.

Tight credit standards prevented millions of home purchases in 2009-2013

Four million more home mortgages nationwide would have been made between 2009 and 2013 if credit standards had been similar to 2001 levels, according to a new report from the Urban Institute.

Four million more home mortgages nationwide would have been made between 2009 and 2013 if credit standards had been similar to 2001 levels, according to a new report from the Urban Institute.