Many Vermont households were displaced after July’s flooding and are in need of housing. The Federal Emergency Management Agency (FEMA) is seeking information from current rental/residential, multi-family property owners and managers in order to provide temporary housing to eligible FEMA applicants.

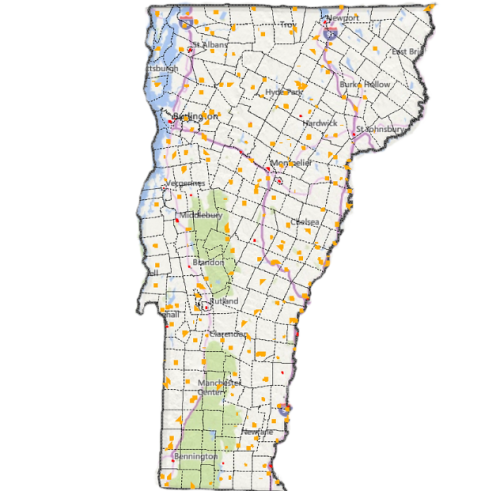

Reimagine how Vermont locations are designated for community development

Join local officials, planners, business and property owners, statewide leaders at the Designation 2050 Design Summit on September 12, 2023. Hear about the findings of the Designation Program Evaluation underway and help design the future of these programs – and Vermont.

Business emergency program opening today can help Vermont landlords with flood recovery

The Vermont Business Emergency Gap Assistance Program (BEGAP) opening today can assist a variety of small businesses impacted by July flooding, including landlords. Landlords may receive assistance up to $20,000 for up to three properties. Properties with extensive damage may qualify for up to $100,000.

New smart-growth opportunities and resources for Vermont communities

Vermont communities now have more ways to promote inclusive, smart growth. Last week, the Vermont Department of Housing and Community Development launched the Community Partnership for Neighborhood Development grant program and is accepting applications.