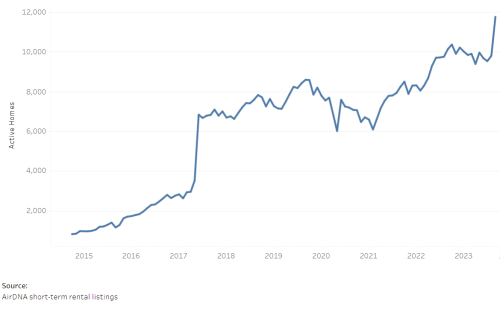

New data on Vermont’s short-term rental (STR) market now available on HousingData.org shows a continued increase, up to 11,747 homes statewide in September 2023. Additionally, historic data has been added to the site, now displaying monthly figures, starting in October 2014.

First Generation Homebuyer Program Update

The State of Vermont has renewed funding for the First Generation Homebuyer Program. Originally released as a pilot program in 2022, the program is now widely available and offers eligible homebuyers a $15,000 grant to help with down payment and closing costs.

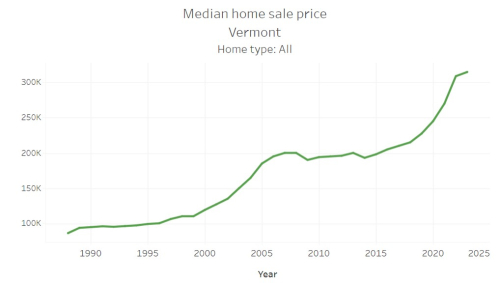

Vermont home prices continue increasing in first half of 2023

The median sales price of primary homes sold in Vermont continued increasing in the first half of 2023, reaching a median value of $315,000 for homes sold during that period, according to recent Vermont Property Transfer Tax (PTT) records. This continues a trend in which no county in Vermont has seen a decline in annual median home sale price during the period from 2019-2022.

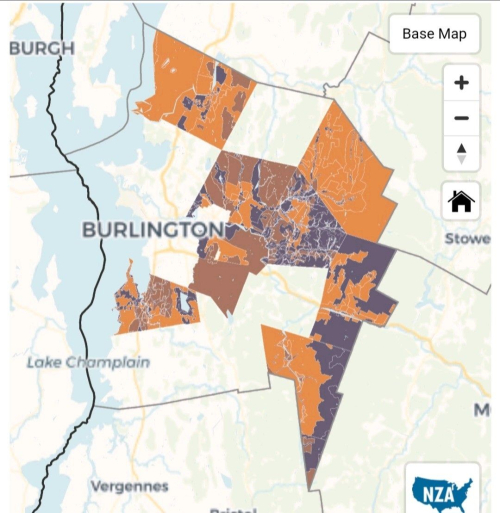

Help build the Vermont Zoning Atlas

The Vermont Zoning Atlas team is seeking volunteers to help complete its build-out across the state. This is an exciting opportunity to join a national data standardization project, be part of a grassroots team and be among the first researchers to work with raw zoning data across Vermont. The project started this summer by focusing on Chittenden County towns.

Vermont Housing Data website gets comprehensive update with latest data available

The most recent data available has been added to the Vermont Housing Data website at www.housingdata.org which is managed by VHFA. The updates to the website include the most recent American Community Survey (ACS) 5-year estimates from the U.S. Census Bureau as well as new data from the Multiple Listing Service (MLS), the Vermont Department of Taxes, the National Low Income Housing Coalition’s (NLIHC) Out of Reach report, and more.

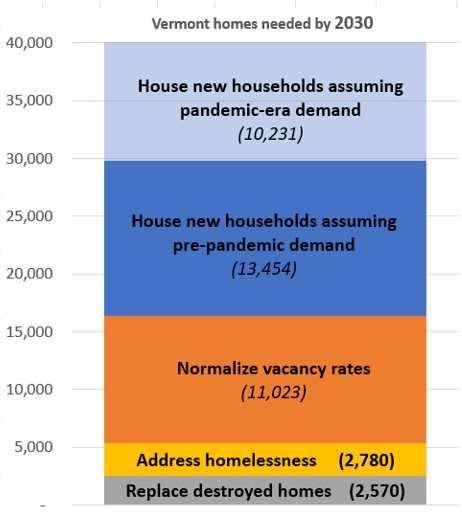

Why Vermont needs 30,000-40,000 more homes

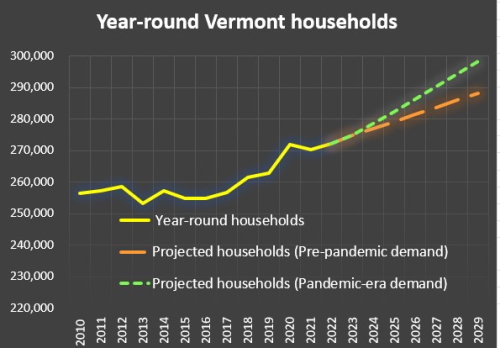

Earlier this year VHFA projected a need for 30,000-40,000 more homes by 2030. These projections are based on data from the U.S.

New data shows unprecedented jump in Vermont median home price

The median price of a Vermont home jumped to $310,000 in 2022, an historic 15% increase from the prior year. This is the largest annual percentage increase in the median sales price of primary homes since 1988 when the Vermont Department of Taxes began publishing home sales data.

30,000 to 40,000 more Vermont homes needed by 2030

To meet expected demand and normalize extremely low vacancy rates, Vermont will need 30,000-40,000 more year-round homes by 2030. This means adding 5,000 to 6,700 more homes to Vermont's primary home market each year, well above the 2,100 homes that the state has been generating.

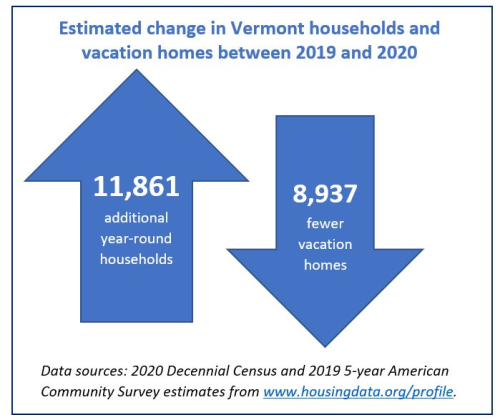

Did Vermont's population jump in 2020?

According to the Census Bureau's 2020 count, 17,336 more people and 15,448 more households considered Vermont their primary home than in 2010, despite earlier predictions of near zero growth in the statewide tally.

Rising interest rates and prices decrease home affordability

Increasing mortgage interest rates and home prices have rapidly made it much more difficult for Vermonters to purchase their first homes. About half as many renters can afford to purchase their first home in 2022 compared to 2021, based on VHFA’s recent analysis of sales price and interest rate trends.