More than one in three Vermont households live in homes that consume unsustainably high portions of their income, according to estimates from the U.S. Census Bureau.

Nation’s housing stock inadequate for changing demographics

America’s housing stock was primarily built for nuclear families, yet fewer and fewer households fit into that category, according to Making Room: Housing for a Changing America, a new report from AARP. The report argues that communities need to create housing that is more affordable and accessible for single-person, senior, and multi-generational households.

Record Vermont home prices highlight affordability concerns

Vermont home prices reached new highs in 2018, continuing a four year trend of growth. However, household incomes have not kept pace, making it increasingly difficult for low and middle-income Vermonters to become homeowners.

Housing vital to Vermont economy, but many millennials are left out of the market

Last week, VHFA Executive Director Maura Collins spoke on a housing panel at the Vermont Economic Conference in Burlington. She was joined by Jonathan Slason of Resource Systems Group, Inc. and moderator Leslee MacKenzie of Coldwell Banker Hickok & Boardman Realty.

Thriving Communities initiative seeks local housing info

The CVOEO Fair Housing Project, through its Thriving Communities initiative, is creating an online Housing Committee Toolkit, which will include success stories, best practices, and resources for existing local groups and communities who want to learn more about housing committees.

Vermont's improving economy helps some but leaves other behind

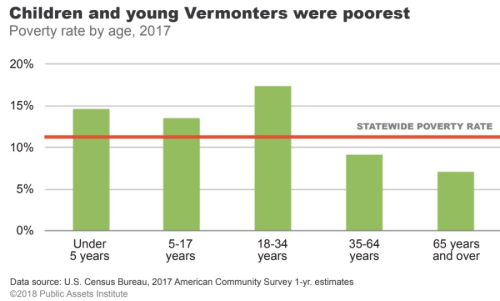

Vermont’s economy is growing but not in every county, and its gains have disproportionately benefited higher income Vermonters, according to the 2018 update of “State of Working Vermont” from Public Assets Institute. Poverty is distinctly more prevalent among younger Vermonters and Vermonters of color, the report notes.

Housing tax credit program provides major benefits for Vermont economy

New estimates from the ACTION Campaign demonstrate the significant impact that the Low-Income Housing Tax Credit has had in Vermont, including creating and preserving over 7,000 affordable homes since 1986 and supporting nearly 8,000 jobs per year.

VHFA introduces new web tools to help Vermonters find apartments and information about their towns

Vermont Housing Finance Agency (VHFA) announced today the launch of a robust, free resource connecting Vermonters to information about housing vacancies and community needs. Low and moderate income Vermonters who lack adequate, stable housing they can afford suffer elevated health and safety risks.

With housing costs the biggest financial stress for Vermonters, you can’t afford to miss the Vermont Statewide Housing Conference

Last week, Sarah Carpenter, Executive Director of Vermont Housing Finance Agency (VHFA), sat down with Vermont Public Radio’s (VPR) Howard Weiss-Tisman to discuss the results of the annual VPR-Vermont PBS poll. The poll revealed that housing costs are the primary source of financial stress for Vermonters and that respondents believed that lower housing costs would make Vermont significantly more affordable.

Decline in household incomes raises concerns about VT economy

A recent article in the Burlington Free Press highlights Vermont’s stagnating household incomes, raising concerns over the strength of its economy and the ability of its residents to afford housing.