Vermont Finance Agency (VHFA) has worked with local financial institutions to fund affordable homes that will be sold to low- and moderate-income Vermonters. Passumpsic Bank, Union Mutual Insurance, Community National Bank, National Life, Northfield Savings Bank, and Union Bank invested in Vermont Affordable Housing Tax Credits available through VHFA.

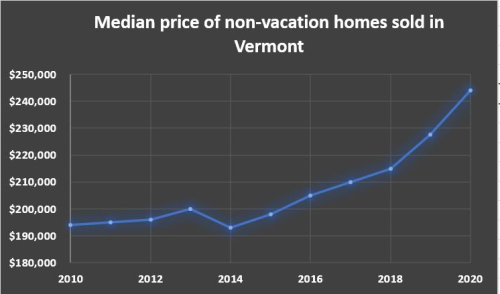

Vermont home prices continued increasing through September 2020

The median price of a non-vacation home in Vermont rose to $244,000, according to Vermont property transfer tax records for homes sold through September 30, 2020. While the 7% increase from 2019 may reflect increased demand from the pandemic’s “race for space,” Vermont is no stranger to rising home prices which have increased steadily since 2014.

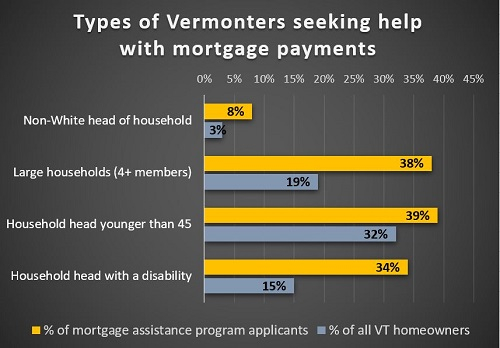

Vermont COVID Emergency Mortgage Assistance applications accepted through November 6

November 6, 2020 will be the last day for Vermont homeowners behind on their mortgage payments due to COVID to submit applications for mortgage assistance grants. Funded by the federal CARES Act, Vermont Mortgage Assistance grants for up to 6 months of missed payments are available to any homeowner who meets eligibility criteria, even if they have already arranged a forbearance agreement.

Vermont Legislature and Governor expand options for accessory dwelling units

Vermont sealed the approval of legislation this week to ease the challenges faced by residents seeking to add an accessory dwelling unit (ADU) to existing resident

VHFA lowers rates to help homebuyers

Homebuyers need every advantage they can get in today’s COVID-impacted housing market. To help homebuyers in Vermont, VHFA is temporarily lowering rates for homebuyers who use VHFA MOVE, and VHFA will not charge a premium for buyers using VHFA MOVE with ASSIST down payment and closing cost assistance. These lower rates will be for a limited time only while funds last.

Vermonters with pandemic hardship will get grants for overdue mortgage payments

When Kimberly Edgar was unable to work due to COVID-19, the new Mortgage Assistance Program offered her a path for keeping her home in Brattleboro. Funded by the federal CARES Act, the program provides qualified Vermont homeowners with grants for up to six months of overdue mortgage and property tax payments.

VHFA awards state tax credits for affordable homeownership development

Last week the VHFA Board of Commissioners awarded state housing tax credits for five affordable homeownership development projects. In total, VHFA allocates $1,075,000 in state housing tax credits each year, $425,000 of which was awarded last week for affordable homeownership development. Once sold to investors, those credits will yield approximately $1.9 million in equity for construction.

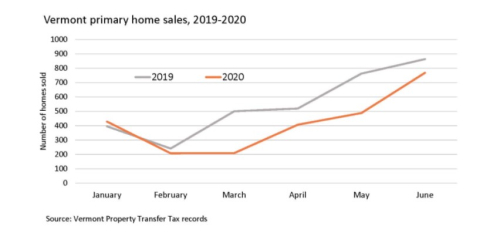

Vermont housing market remains steady during pandemic

Despite the impact of the coronavirus pandemic, Vermont home prices continued to climb in the first six months of 2020, based on the latest data from Vermont Property Transfer tax records. The median home sold for $234,940, a roughly 3% increase from 2019.

Five things to know about pre-approvals

VHFA offers loan programs through local participating lenders to help people bridge the gap and afford to buy a home in Vermont. Getting a pre-approval from a lender is the first step in the process. Here are answers to the top 5 questions homebuyers have about pre-approvals.

Webinar on challenges and resources for homeowners on July 31

Champlain Valley Office of Economic Opportunity (CVOEO)'s Fair Housing Project will host a free, hour-long webinar on Friday, July 31 at 12:30 p.m.