The Vermont Housing Finance Agency (VHFA) Board of Commissioners announced last week that its annual award of federal housing tax credits will support the construction of 112 homes in perpetually affordable apartment buildings in four communities across the state. The sale of this year’s tax credits to investors is expected to yield over $28 million in funds covering an estimated 60 percent of total project development costs.

Olivia LaVecchia joins VHFA as Community Development Underwriter

Olivia LaVecchia of Burlington has joined VHFA in the role of Community Development Underwriter.

Learn more about the “10% in Vermont” local investment program

A webinar on applying for the “10% in Vermont” local investment program will be held at noon on April 17, with applications for the program due June 1, 2023.

FHLBank Boston hosts Community Forum on April 19, 2023

FHLBank Boston is hosting the Community Impact and Partnership Forum for Vermont lenders and community leaders.

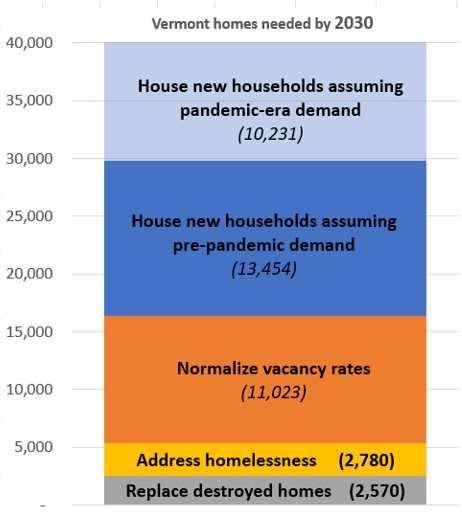

Why Vermont needs 30,000-40,000 more homes

Earlier this year VHFA projected a need for 30,000-40,000 more homes by 2030. These projections are based on data from the U.S.

Innovative state program funds new homes for middle- and lower-income Vermont buyers

On Monday, the Vermont Housing Finance Agency (VHFA) Board of Commissioners awarded $14.2 million to 12 projects totaling 92 homes across eight counties as part of the Missing Middle-Income Homeownership Development Pilot Program (Missing Middle-Income Program). The program represents the largest single investment in the state’s history to create new homeownership opportunities.

Alyssa Peteani joins VHFA as Community Development Underwriter

Executive Director Maura Collins announced that Alyssa Peteani (she/her) of Burlington has joined VHFA in the role of Community Development Underwriter.

Peteani has over eight years of experience working for Champlain Housing Trust (CHT). As a Senior Loan Officer at CHT, her work involved underwriting and closing loans for the Manufactured Housing Down Payment Program. She has also worked in the role of Shared Equity Coordinator at CHT.

Missing Middle Program Application Deadline Extended to January 27

On June 7th 2022, Governor Scott signed legislation that provides $15 million in funding for the Missing Middle-Income Homeownership Development Pilot Program. The program will be initially funded from a portion of the state’s American Rescue Plan Act funding. The program will provide subsidies and incentives for home builders to construct or rehabilitate modest homes affordable to Vermont homebuyers at 120% of Area Median Income or lower. VHFA launched the program in December 2022.

New program launches to increase homeownership opportunities for Vermonters

MIDDLEBURY, VT - With many Vermonters feeling stuck because of the increasing costs of homes and the dire lack of availability, officials announced a new program to build more moderately priced homes across the state. The Missing Middle-Income Homeownership Development Program will provide subsidies and incentives for home builders to construct or rehabilitate modest homes affordable to Vermont homebuyers at 120% of the area median household income or lower.

Butternut Grove Condominiums Celebrated in Winooski

VHFA joined housing partners and residents on September 8 to celebrate the completion of Butternut Grove Condominiums in the heart of Winooski. Developed by Champlain Housing Trust (CHT), the newly constructed building offers 20 shared equity homes starting at $143,500 for a 2 bedroom, 1.5 bath unit and up to $184,500 for a 3 bedroom 2.5 bath unit.