VHFA's Executive Director Sarah Carpenter announced today that interested parties are invited to submit comments on how housing tax credits are allocated. Housing tax credits are Vermont’s primary funding source for developing affordable rental housing. The comments will be considered during this year’s upcoming revisions to Vermont’s Qualified Allocation Plan (QAP). As administrator of the housing tax credit program, VHFA allocates credits to specific projects in accordance with identified State needs and Federal requirements outlined in the Vermont QAP. Vermont’s inter-agency Joint Committee on Tax Credits reviews allocation policies and process and makes recommendations on the QAP to VHFA’s Board of Commissioners.

Data and Statistics

New fact sheets show impact and need for housing tax credits in VT

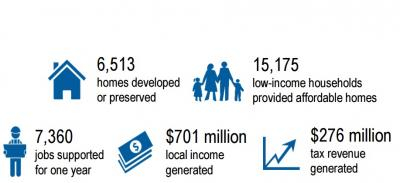

In Vermont, the federal Low-Income Housing Tax Credits allocated by VHFA have financed 6,513 apartments, providing affordable homes to 15,175 low-income Vermont households and supporting 7,360 jobs. However, 15,061 households in Vermont still pay more than half of their income towards rent, and the average minimum wage worker has to work 89 hours per week in order to afford a modest-two bedroom apartment, underscoring the need to expand the Housing Credit.

Need an affordable apartment?

Need an affordable apartment or know someone who does? Vermont has plenty of options! There are vacancies in 15 different apartment complexes across the state, according to the Vermont Directory of Affordable Rental Housing.

Demand drives new home construction in northwest Vermont

Demand for apartments and denser neighborhoods is driving home construction in Chittenden and Franklin counties this year according to a recent article in Vermont Business Magazine that surveyed area builders and housing experts, including VHFA Executive Director Sarah Carpenter.

Carpenter explained that "more people are delaying the purchase of their first home and that in turn has put pressure on the rental market."

The number of multifamily project building permits in the Burlington South Burlington area shot up 72% during the first half of 2016 over the same period a year earlier, according to the National Association of Home Builders.

Vermont's median household income and poverty rate improved in 2015

The median income among Vermont households increased in 2015 to $56,990, according to US Census Bureau estimates released this week. The last time this indicator increased for Vermont was 2011.

Improvements in household income in 2015 were experienced nationwide and reported earlier this week by the Census Bureau.

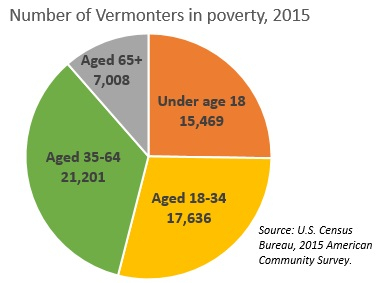

Poverty rate estimates also decreased in Vermont and the U.S. for 2015. Vermont's estimated poverty rate decreased to 10.2% in 2015, with an estimated 61,000 Vermonters below the poverty line. Twenty-five percent of Vermonters living in poor households are children.

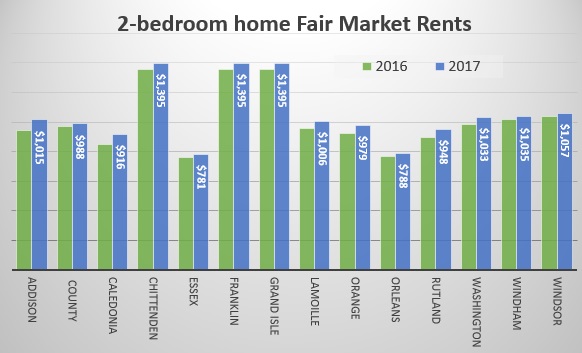

Fair market rents rise in every Vermont county

On October 1, 2016, the Fair Market Rents in every Vermont county will go up. Fair Market Rents are intended to represent the dollar amount below which 40 percent of the standard-quality rental housing units in an ar

On October 1, 2016, the Fair Market Rents in every Vermont county will go up. Fair Market Rents are intended to represent the dollar amount below which 40 percent of the standard-quality rental housing units in an ar

Stakeholder input needed for roadmap to end homelessness in Vermont

A steering committee of housing and service providers, state agencies and funding organizations is working to reduce homelessness and stabilize vulnerable populations. The committee’s current goal is to develop a system for facilitating service-connected affordable housing options, building local capacity, determining costs and identifying available and needed resources.

Prevalence of housing cost burden increases for rural Vermonters

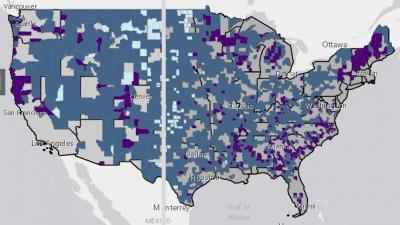

More than 30 percent of the households in Vermont’s rural counties are now cost burdened by their housing expenses—a stark increase since 2000, according to a recent Harvard analysis of non-metro areas nationwide. This interactive map shows the increase in cost burden rates sweeping U.S. rural areas.

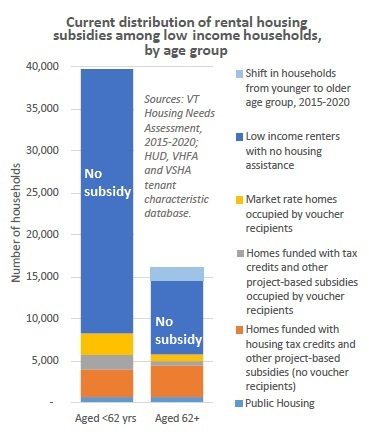

The critical, and mathematical, role of tax credits and other sources in housing low-income Vermonters

Ever wonder why it's not easier to build affordable apartments? A new interactive tool developed by the Urban Institute illustrates the mathematical necessity of tax credits, loans, tenant income/rent and grants in paying for the costs of affordable housing. Check it out to see if you can make the math work!

With a constantly evolving funding toolbox, VHFA's skilled development and multifamily management staff work with Vermont's affordable rental housing developers and managers day in and day out to overcome these challenges and maximize the number of affordable apartments available for low-income Vermonters.