The CVOEO Fair Housing Project, through its Thriving Communities initiative, is creating an online Housing Committee Toolkit, which will include success stories, best practices, and resources for existing local groups and communities who want to learn more about housing committees. The toolkit is intended to stimulate community conversations, local leadership, and policy change to increase inclusive, fair, and affordable housing.

Data and Statistics

Vermont's improving economy helps some but leaves other behind

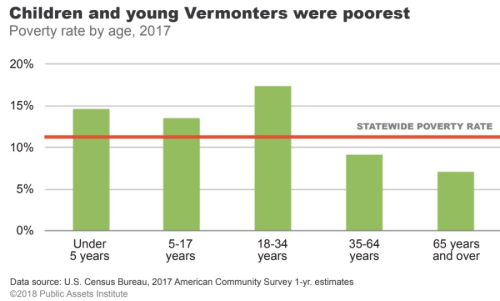

Vermont’s economy is growing but not in every county, and its gains have disproportionately benefited higher income Vermonters, according to the 2018 update of “State of Working Vermont” from Public Assets Institute. Poverty is distinctly more prevalent among younger Vermonters and Vermonters of color, the report notes.

The northwestern part of the state accounted for all job growth in Vermont in the last decade, according to the Public Assets Institute report. While employment grew in Chittenden, Franklin and Washington counties, the remaining counties lost 15,000 workers.

Housing tax credit program provides major benefits for Vermont economy

New estimates from the ACTION Campaign demonstrate the significant impact that the Low-Income Housing Tax Credit has had in Vermont, including creating and preserving over 7,000 affordable homes since 1986 and supporting nearly 8,000 jobs per year.

Decline in household incomes raises concerns about VT economy

A recent article in the Burlington Free Press highlights Vermont’s stagnating household incomes, raising concerns over the strength of its economy and the ability of its residents to afford housing.

UVM economics professor Art Woolf writes that according to the 2017 estimates recently released by the U.S. Census Bureau, Vermont’s median household income is $57,513, ranking it 27th in the country. However, the Vermont household median income actually decreased by 2.4 percent from 2016, just as the national median household income increased by 2.5 percent.

New research shows path to affordable, sustainable homeownership

A recent report from researchers at Ohio State University and Fannie Mae describes new evidence of ways to extend homeownership sustainably. Lower income households seeking to purchase homes face many barriers including lack of wealth for down payment. Further, “after purchasing a home, lower income homeowners are often at higher risk of default due to unaffordable mortgage terms, higher loan-to-value ratios, and fragile household balance sheets,” the report notes.

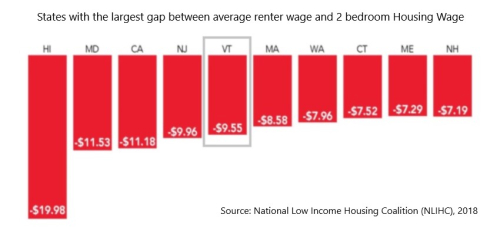

Rent unaffordable for many Vermont workers

The latest edition of the annual report on rental housing affordability from the National Low Income Housing Coalition and the Vermont Affordable Housing Coalition has found that Vermont has one of the highest gaps in the nation between the cost of rent and renter wages. Out of Reach: The High Cost of Housing reports that for a Vermont renter to be able to afford a modest two bedroom apartment, he or she would need to earn $22.40 per hour, well above the average renter wage.

Congressional report highlights housing crisis

A task force convened by the New Democrat Coalition, a group of moderate Democrats in the U.S. House of Representatives, has found that housing is becoming increasingly unaffordable and unavailable for many Americans. In the report, Missing Millions of Homes, the Coalition linked the lack of affordable housing to a combination of wage stagnation and decreased construction.

Need an affordable apartment?

Need an affordable apartment or know someone who does? There are vacancies in 26 different apartment complexes across the state, according to the Vermont Directory of Affordable Rental Housing.

VHFA awards millions in tax credits for affordable rental housing development

On Monday, April 16 the Vermont Housing Finance Agency (VHFA) Board of Commissioners committed federal Housing Tax Credits and Vermont Affordable Housing Credits to construct and renovate apartments for low-income Vermonters over the next several years. The $3.5 million in ten-year federal capped credits, $319,000 in ten-year federal uncapped “bond” credits and $173,000 in five-year state credits will support the development of 251 apartments in eight communities across the state. VHFA permanent and construction financing totaling $19 million was also approved for five of the projects.